A Smart, Convenient Way to Protect

Large Deposits.

The Certificate of Deposit Account Registry Service, or CDARS, is the easiest, most convenient way to safeguard your large deposits.

Individuals, family trusts, businesses, nonprofits, government entities, advisors and other investors can rest easy knowing their funds have access to millions in aggregate FDIC insurance across IntraFi’s network of banks. Enjoy the convenience of working directly with Community Commerce Bank, a local bank you know & trust. It’s easy to get started![2]

Open An Account Today!

Our customer service representatives are ready to answer any questions you might have to open an account to be used with CDARS. Complete the form below, and we will reach out to you directly.

Enjoy Peace of Mind

Relax knowing that your funds are eligible for millions of dollars in aggregate FDIC insurance across network banks, protection that’s backed by the full faith and credit of the United States government. No one has ever lost a penny of FDIC-insured deposits.

Save Time

Work directly with us―a bank you know and trust―to access FDIC insurance on large dollar deposits and say ‘goodbye’ to tracking collateral on an ongoing basis, managing multiple bank relationships, manually consolidating bank statements, and other time-consuming workarounds.

Maintain Flexibility

Select from multiple term options, including 4 weeks, 13 weeks, 26 weeks, 1 year, 2 years, and 3 years.

Earn Interest

Earn one interest rate per CD maturity.

Support Your Community

Feel good knowing that the full amount of your funds placed through CDARS can stay local to support lending opportunities that build a stronger community.[1]

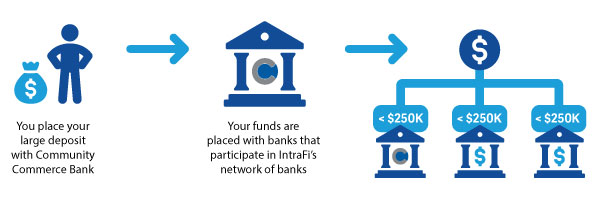

Institutions, like ours, that offer CDARS are members of the IntraFi network. When we place your funds through the CDARS service, that deposit is divided into amounts under the standard FDIC insurance maximum of $250,000. The funds are then placed into CDs at multiple banks. As a result, you can access coverage from many institutions while working directly with just one. You receive one regular statement from our bank and as always, your confidential information is protected.

Sign a CDARS Deposit Placement Agreement and a Custodial Agreement with Community Commerce Bank.

Based on our current CD options, you agree to a rate and a maturity that best match your investment goals.

Using the CDARS service, we place your funds for placement at member network banks.

Member banks issue CDs in denominations under the FDIC maximum, so your investment is eligible for FDIC coverage.

You receive written confirmation of your deposits and a listing of all of your CDs.

You will receive one regular account statement listing all of your CDs, their issuing banks, maturity dates, and other details. With CDARS, there’s no need to manually consolidate statements or track collateral values on an ongoing basis.

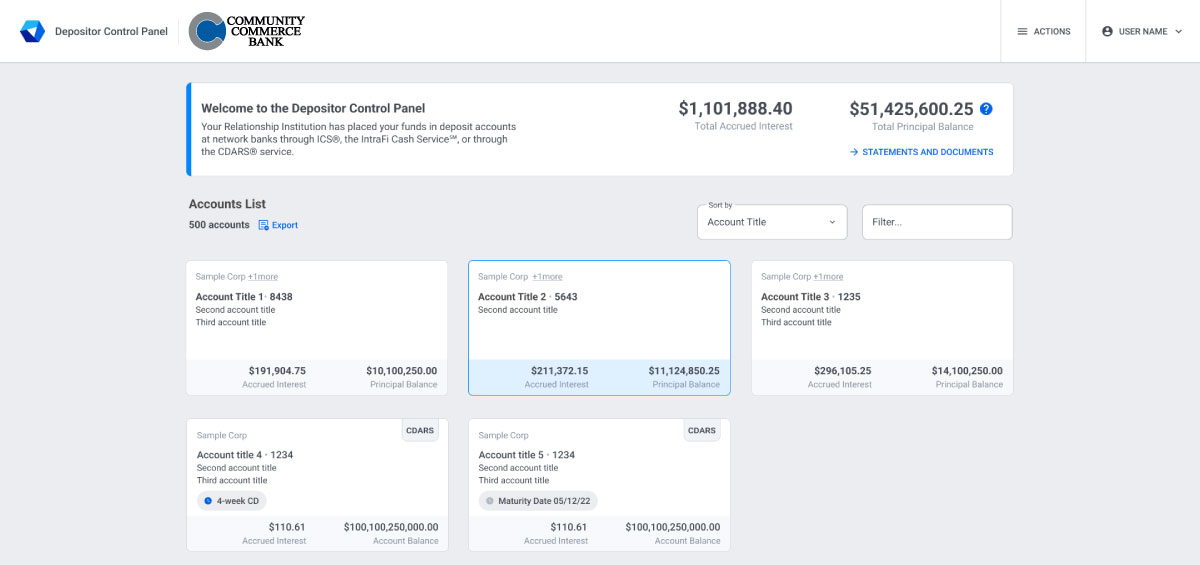

When you choose CDARS, you gain access to the Depositor Control Panel (DCP).

The DCP is a secure website that was specially created to help you manage your CDARS placements.

PUT CDARS TO WORK FOR YOU!

Any organization or individual who wants to combine the convenience of having a single bank relationship with the security of FDIC insurance can benefit from CDARS.[2]

Individuals, businesses, nonprofits, government entities, advisors (trustees, trust officers, lawyers, accountants, financial advisors/planners, and other fiduciaries), and other investors can:

A list identifying IntraFi network banks can be found at IntraFi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply. To meet conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage.

Yes, your confidential information is kept secure, and your relationship remains between you and Community Commerce Bank.

You get to enjoy the convenience of having your funds allocated to multiple banks to access FDIC protection without you doing any of the heavy lifting.[2]

Yes. In 2003, a bank asked the FDIC to provide an opinion relating to CDARS. The FDIC provided a letter to the bank stating that it agreed that deposits placed through CDARS would be insured on a pass-through basis under the FDIC’s rules on the insurance coverage of agency or custodial accounts.

In the 20+ years that IntraFi has offered its services, there have been several occasions on which a bank holding funds placed through CDARS failed and the FDIC was unable to find a healthy bank to acquire the deposits. In each of those cases, the FDIC paid insurance claims, and depositors were made whole.

Additionally, federal law recognizes reciprocal deposits. The Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018 defines reciprocal deposits and provides that certain reciprocal deposits are deemed not to have been obtained by or through a deposit broker. The FDIC subsequently issued regulations to implement the Act’s requirements.

When a Destination Institution (DI) holding your funds fails, the failure impacts only the amount of funds that have been placed at that DI, which will be an amount that does not exceed $250,000. Deposits placed through CDARS and ICS at other DIs will not be affected.

Most often, the FDIC finds a healthy bank to assume the deposits of the failed DI. For funds placed in CDs through CDARS, the assuming DI may accept the deposit on the same terms or may offer the depositor a choice of receiving early payment on the CD without penalty or maintaining the CD at a different rate. (See the CDARS Deposit Placement Agreement for more information.)

In cases where the FDIC is unable to find a healthy institution that is willing to accept the transfer, it pays insurance claims of depositors. The FDIC is obligated to pay these claims as soon as possible and has typically done so within a few business days of the bank failure.

When a depositor places funds through CDARS, the amount is divided into smaller portions that do not exceed the standard FDIC limit of $250,000 and funds are deposited into accounts at multiple network member banks in amounts not exceeding $250,000 per bank. As a result, the deposits are eligible for FDIC insurance coverage at each destination bank. By partnering exclusively with Community Commerce Bank, depositors can access insurance coverage from multiple institutions.

Deposit placement through an IntraFi service is subject to the terms, conditions, and disclosures in applicable agreements. Deposits that are placed through an IntraFi service at FDIC-insured banks in IntraFi’s network are eligible for FDIC deposit insurance coverage at the network banks. The depositor may exclude banks from eligibility to receive its funds. To meet conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA before settlement for deposits or after settlement for withdrawals. The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through an IntraFi service satisfies any restrictions on its deposits. IntraFi, CDARS, Certificate of Deposit Account Registry Service, Bank Safe, Bank Smart, and the IntraFi logo are registered trademarks of IntraFi LLC.

[1] When deposited funds are exchanged on a dollar-for-dollar basis with other institutions that use CDARS, our bank can use the full amount of a deposit placed through CDARS for local lending, satisfying some depositors’ local investment goals or mandates. Alternatively, with a depositor’s consent, our bank may choose to receive fee income instead of deposits from other participating institutions. Under these circumstances, deposited funds would not be available for local lending.

[2] A list identifying IntraFi network banks appears at www.intrafi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply.

[3] Consult with a Community Commerce Bank customer service representative regarding available rates.

Our Branches and Customer Service will be closing at 12pm PDT on Friday, April 3rd for Good Friday.

Our Branches and Customer Service will be closed Tuesday, March 31st in observance of Cesar Chavez Day.

Our Branches and Customer Service will be closed Monday, May 25th for Memorial Day.

Our Branches and Customer Service will be closed Friday, June 19th for Juneteenth.

Our Branches and Customer Service will be closed Friday, July 3rd in Observance of Independence Day.

Our Branches and Customer Service will be closed Monday, September 7th for Labor Day.

Our Branches and Customer Service will be closed Monday, October 12th for Columbus Day.

Our Branches and Customer Service will be closed on Wednesday, November 11th in honor of Veterans Day.

Our Branches and Customer Service will be closed Thursday, November 26th & Friday, November 27th for Thanksgiving.

Our Branches and Customer Service will close at 12pm PST on Thursday, Dec 24th and all day Friday, Dec 25th for Christmas.

Our Branches and Customer Service will close at 12pm PST on Tuesday, Dec 31st and all day Wednesday, Jan 1st for New Years.

Our Branches and Customer Service will be closed on Monday, January 19th in observance of Martin Luther King Jr. Day.

Our Branches and Customer Service will be closed Monday, February 16th for Presidents' Day.

Our Branches and Customer Service will close at 12pm PST on Thursday, Dec 31st and all day Friday, Jan 1st for New Years.